Investment Strategies

Värde invests in three core segments with diverse strategies in each segment.

CORPORATE AND TRADED CREDIT

Investments in opportunistic and dislocated traded credit, as well as restructurings and liquidations in corporate, structured product, sovereign, and other credit instruments and related assets.

REAL ESTATE

Debt and equity investments related to commercial and residential real estate in public and private markets.

FINANCIAL SERVICES & DIVERSIFIED PRIVATE CREDIT

Investments across the entire capital structure in commercial finance, consumer finance, and broader businesses related to financial services including loan portfolios, as well as private credit solutions for technology, software, and other resilient businesses.

Investment Principles

Värde applies a set of core principles to opportunities across the firm’s investing platform. The process, discipline and rigor draw on the firm’s long history in the investing business.

The key tenets of Värde’s investment philosophy are:

- Market Inefficiency & Capital Gaps

- Unlock Value

- Complexity

- Flexibility

- Downside Protection

- Relative Value

Market Inefficiency & Capital Gaps

Identify investment opportunities and develop scalable themes in less efficient markets and/or where there is a favorable imbalance in the relative supply and demand for capital

Unlock Value

Focus on drivers and catalysts to unlock or create value and optimize potential exit strategies

Complexity

Seek opportunities to benefit from Värde’s established expertise and/or differentiated capabilities to unlock complexity in various forms while pricing correctly the inherent risk

Flexibility

Approach investing with flexible capital that allows Värde to operate across private and public assets and securities as well as secondary and primary markets

Downside Protection

Seek to invest at a price that allows Värde to increase value while maintaining a strong focus on discount to fundamental value

Relative Value

Assess risk/reward holistically, searching not only for the best value in any market, but also in comparison with the opportunity set across the global Värde platform

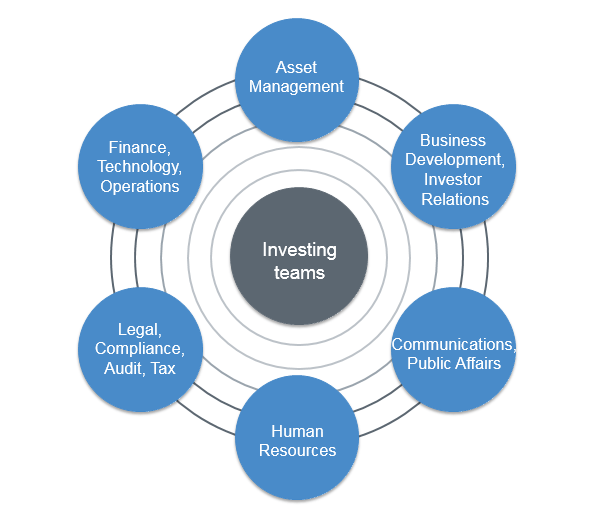

Institutional Operating Model

Värde’s institutional operating model supports its investing activities around the world by aligning key business functions and teams.

Värde Investors

Värde provides investment services to a wide array of investors from around the globe.